Current liabilities: These need to be paid back within a year and include credit lines, loans, salaries and accounts payable.There are three main types of liabilities: Most businesses have liabilities, unless they only accept cash payments and also pay with cash. Liabilities can typically be found on the right side of a balance sheet. The loans are often used to finance your operations, or pay for expansions or new equipment. These include loans, legal debts or other obligations that arise in the course of business operations. Liabilities include everything your business owes, presently and in the future.

Are expenses liabilities on a balance sheet software#

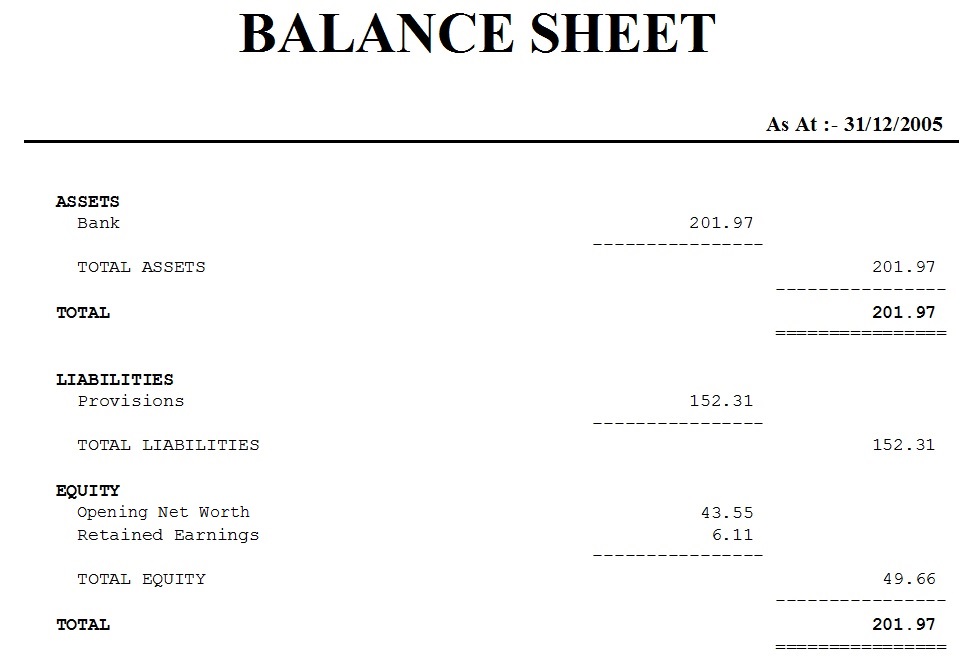

Liabilities, assets and equity are used to evaluate a business’s financial health.Įditor’s note: Looking for the right accounting software solution for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs. For these reasons, it’s important to have a good understanding of what business liabilities are and how they work. Assets and liabilities are used to evaluate your business’s financial standing, and to show its equity by subtracting your company’s liabilities from its assets. In the accounting world, assets, liabilities and equity make up the three major categories of your business’s business balance sheet. What are small business liabilities and assets? You’ll also understand common liabilities for small businesses. Read on to learn what liabilities, assets and expenses are, and how they differ from each other. A liability is anything that results in debt or is a potential risk, and it is used in key ratios to determine your organization’s financial health. This article is for small business owners who want to learn what liabilities are and see examples of common business liabilities.Īs a business owner, it’s likely that you already have some liabilities related to your company.Assets and liabilities are part of a business’s balance sheet and are used to judge the business’s financial health.Assets are items of value that your business owns, such as real estate and equipment.Liabilities are debts or other obligations in which your business owes money, now or in the future.

0 kommentar(er)

0 kommentar(er)